23+ j1 visa tax calculator

Web Our income tax calculator calculates your federal state and local taxes based on several key inputs. Ad Let Our Tax Calculator Tools Help You Understand What Your Tax Refund Will Look Like.

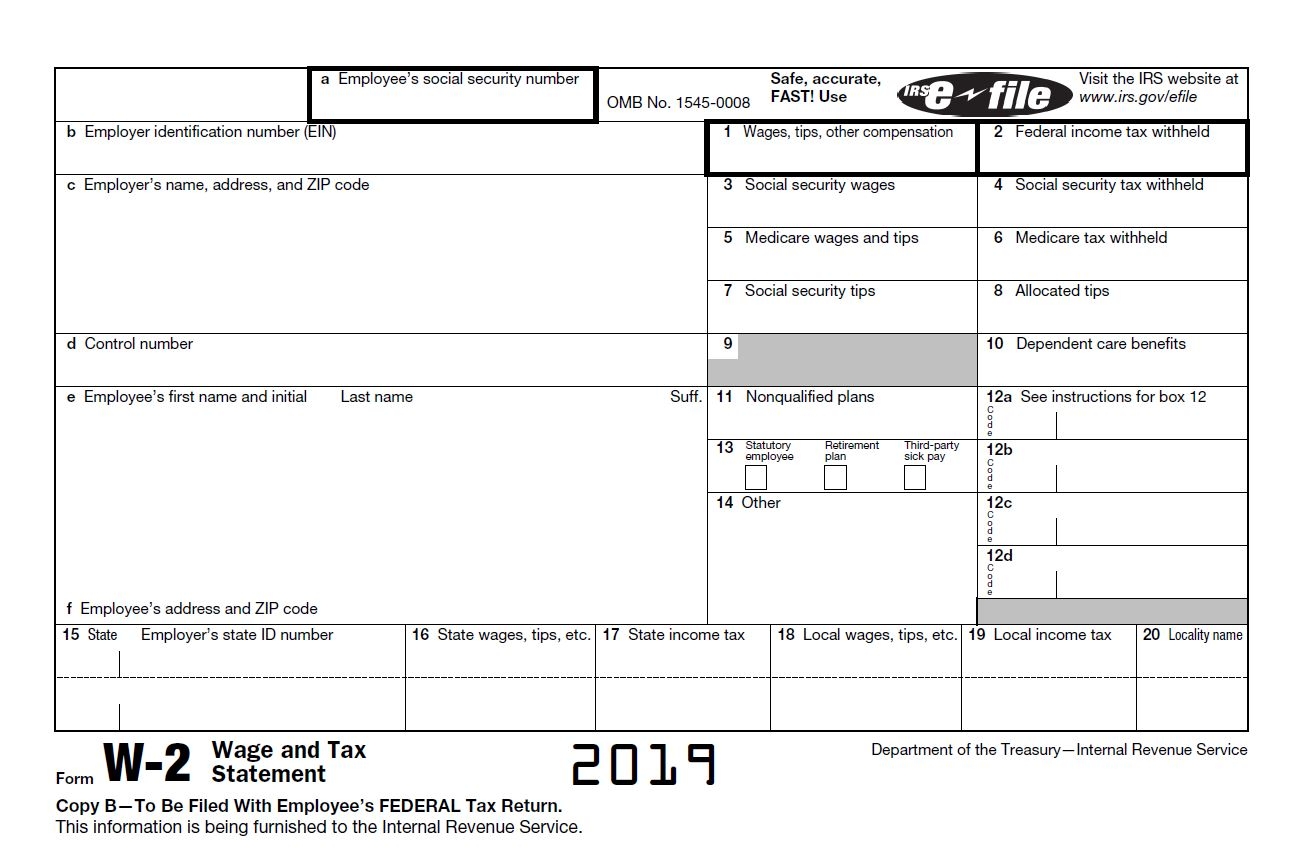

How To File J 1 Visa Tax Return 101 Tfx

Ad Let Our Tax Calculator Tools Help You Understand What Your Tax Refund Will Look Like.

. How much tax will you pay. Web The answer is yes J-1 visa holders can receive tax refunds just like their US. Web Use this free tax return calculator to estimate how much youll owe in federal taxes using your income deductions and credits in just a few steps.

Your household income location filing status and number of. You were physically present in the US. Ad File your federal tax return for FREE and State Only 995.

Whether you will receive a USA J-1 tax refund depends on the status. To determine if you meet the substantial presence test for. Get Rid Of The Guesswork And Accurately Calculate Your Tax Refund With Our Tax Calculator.

Web These visas are given to spouses and dependents of J-1 visa holders. Just fill in the fields which have self-explanatory names and your tax savings will be calculated. File your Free Federal return and State tax return for only 995 at online taxes.

Web J-1 visa holders are entitled to claim tax refunds on both federal and state taxes. Its hard to say how long itll take for you to get your. TaxAct helps you maximize your deductions with easy to use tax filing software.

To do that file your tax return. Get Rid Of The Guesswork And Accurately Calculate Your Tax Refund With Our Tax Calculator. On 120 days in each of the years 2019 2020 and 2021.

File your taxes stress-free online with TaxAct. The tax percentage withheld. Ad Filing your taxes just became easier.

Web For tax filing purposes most J-1 visa holders are considered Nonresident Aliens. Web As a J-1 visa holder you are considered as a non-resident for the first two years since you entered the US. After that if you are more than 183 days within the US.

Web OPT as well as individual students are taxed on their wages at graduated rates from 10 to 396 it depends on your income level. Web Web Estimate how much youll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a few steps with our tax calculator. As Nonresident Aliens J-1 exchange visitors must pay federal state and local taxes.

For the 2023 tax year onwards all nonresidents must pay 10 in.

The Complete J1 Student Guide To Tax In The Us

Number Theory For Co Free

Financial Calculator 1040 Tax Calculator

German Tax Refund Calculator Taxback Com

The Complete J1 Student Guide To Tax In The Us

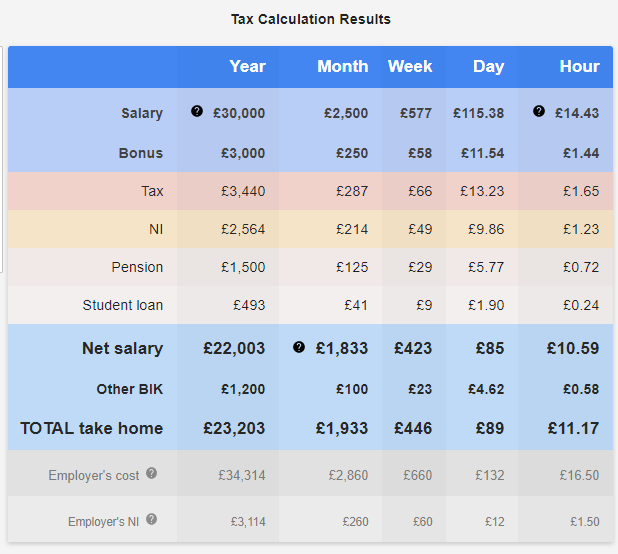

Planning For A Great Financial Future The Savvy Scot

The Complete J1 Student Guide To Tax In The Us

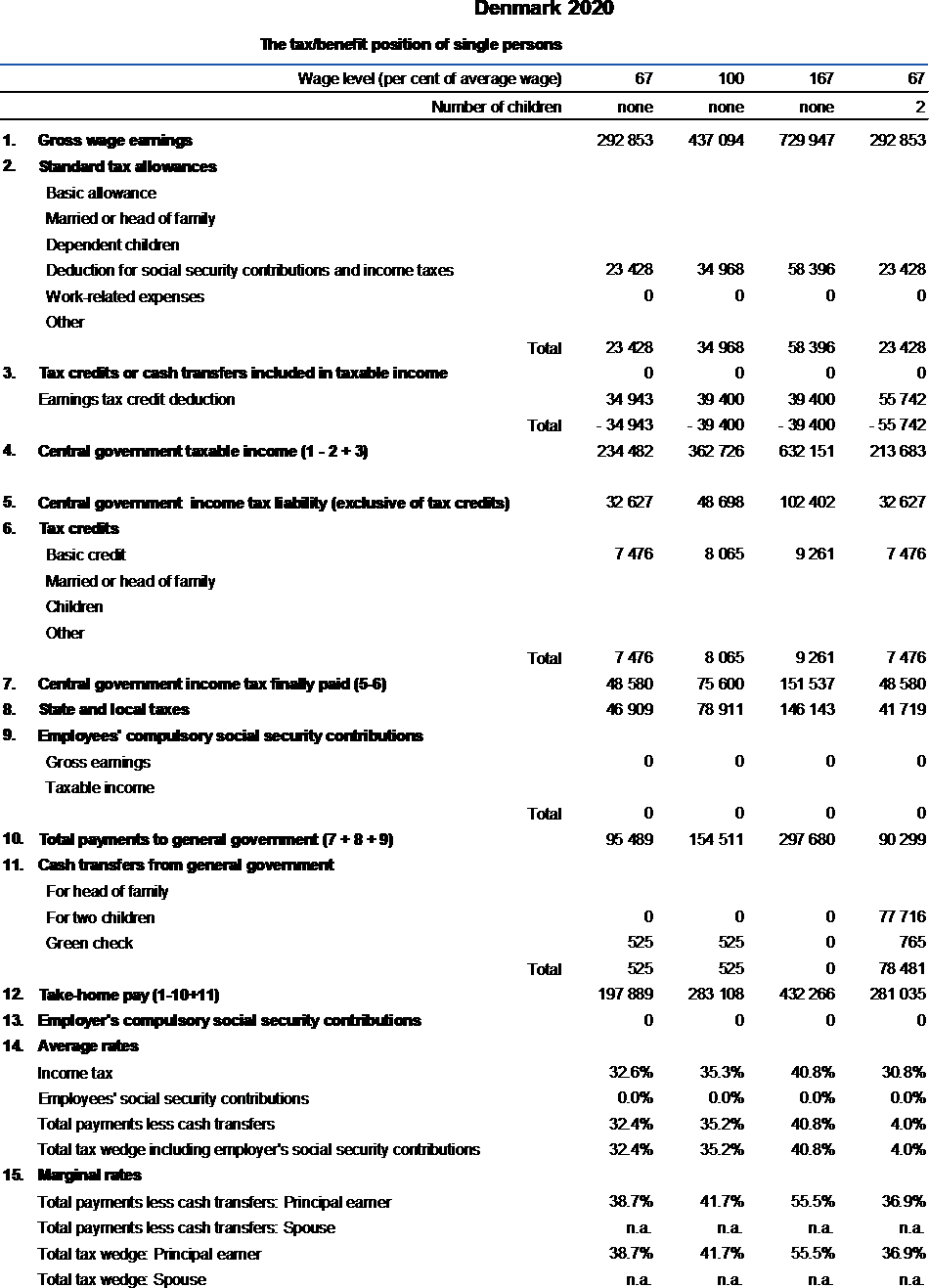

Slovenia Taxing Wages 2020 Oecd Ilibrary

Us J1 Tax Refund Calculator Taxback Com Youtube

Research In The Community Vol 3 By Bay School Issuu

Bernard Magee S Acol Bidding Quiz Number One Hundred And Thirty Seven May 2014 Pdf Contract Bridge Leisure

The Complete J1 Student Guide To Tax In The Us

The Complete J1 Student Guide To Tax In The Us

Denmark Taxing Wages 2021 Oecd Ilibrary

The Complete J1 Student Guide To Tax In The Us

Tax Calculator Employer Tax Benefits J1 Visa Students Exempt From Fica And Futa Taxes

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates